Managing invoices and billing efficiently is crucial for freelancers, small business owners, and entrepreneurs. With the rise of digital finance tools, invoice and billing management apps have revolutionized how professionals create, send, and track payments. These apps simplify complex accounting tasks, automate billing reminders, and ensure you stay on top of your cash flow. Below are seven of the best apps that redefine how you handle your invoicing process.

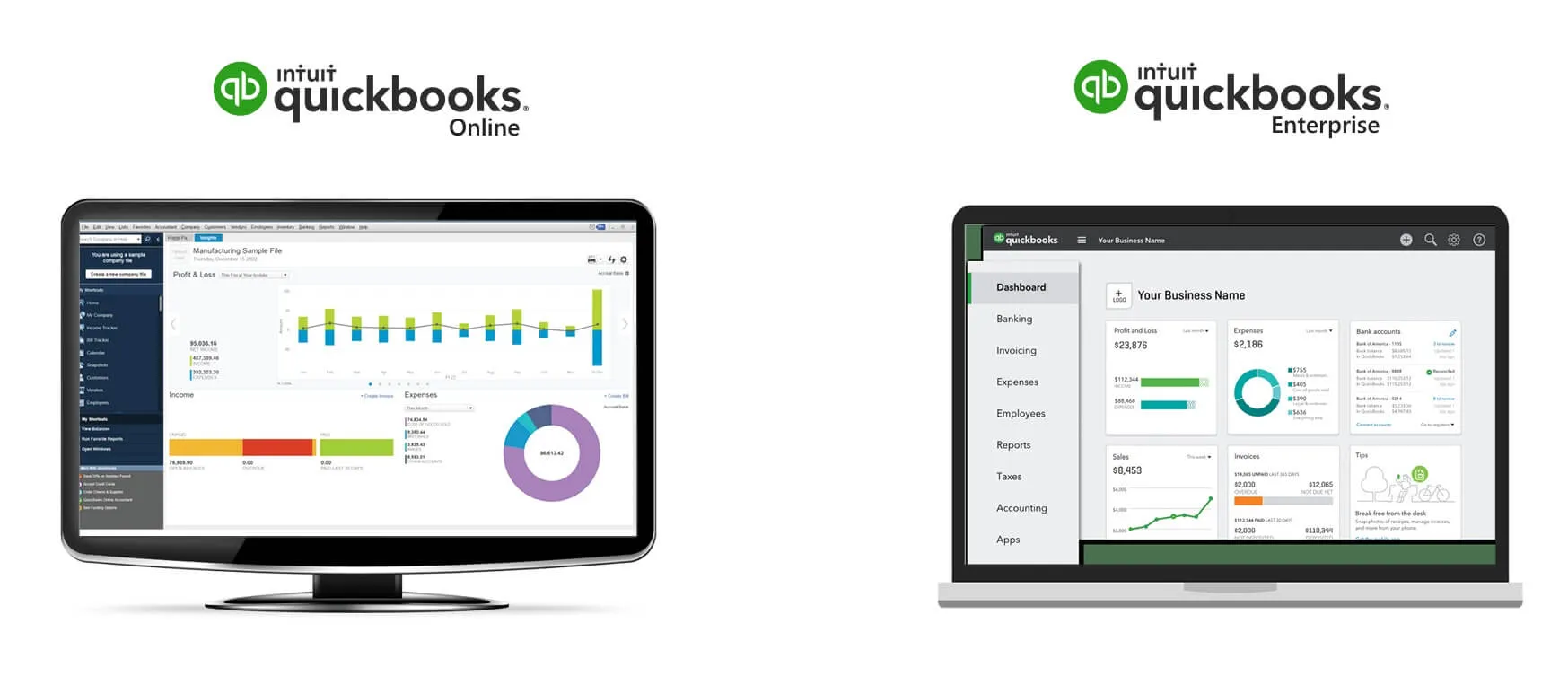

1. QuickBooks – The Complete Accounting and Billing Solution

QuickBooks has long been a household name in small business finance. Its invoice management system is one of the most robust, providing customizable invoice templates, payment reminders, and expense tracking. Users can generate detailed financial reports that offer a clear view of profitability and cash flow trends.

With seamless integration across bank accounts and credit cards, QuickBooks automates the tedious process of reconciling transactions. The mobile app allows users to send invoices on the go and receive notifications when clients make payments. Another strength lies in its automation—repeated billing cycles, late payment alerts, and client segmentation help professionals save valuable time.

QuickBooks also supports multiple currencies and integrates with popular payment gateways like PayPal and Stripe. Whether you’re a freelancer or managing a growing enterprise, QuickBooks simplifies complex accounting into an organized, intuitive experience.

2. FreshBooks – Intuitive Invoicing for Creative Professionals

FreshBooks is known for its beautiful interface and simplicity, making it an ideal choice for freelancers and creative professionals. Its intuitive design makes it easy to create professional invoices in just a few clicks. Users can customize templates with logos, branding colors, and itemized billing details to reflect their brand identity.

Beyond invoicing, FreshBooks excels in time tracking and expense management. Users can log billable hours directly into invoices and track project-specific costs effortlessly. The app also provides detailed performance insights to help users understand revenue flow and client behavior.

FreshBooks automatically sends payment reminders to clients and supports multiple payment methods, including credit cards and bank transfers. Its user-friendly mobile experience ensures invoices can be sent instantly, even during travel or meetings. For small businesses wanting simplicity without sacrificing functionality, FreshBooks stands out as a top contender.

3. Zoho Invoice – Smart Automation for Growing Businesses

Zoho Invoice offers a powerful suite of invoicing and billing tools that cater especially well to startups and growing businesses. Its main appeal lies in automation: recurring invoices, automatic payment reminders, and expense categorization. Zoho’s dashboard delivers real-time insights into outstanding payments, client histories, and tax reports.

Customization is another area where Zoho shines. Users can tailor invoice templates, add detailed tax breakdowns, and generate region-specific financial statements. Integration with the wider Zoho ecosystem (like Zoho Books and Zoho CRM) creates a unified business environment that streamlines operations.

Zoho Invoice also ensures compliance with local tax laws in multiple countries and supports multiple languages and currencies. Its secure cloud platform keeps your billing data accessible yet safe. For modern businesses looking for scalability and automation, Zoho Invoice is an intelligent and affordable choice.

4. Wave – Free, Powerful, and Perfect for Small Businesses

Wave has become one of the most popular free invoicing and accounting apps for small business owners and freelancers. Despite its zero-cost model, Wave delivers a surprisingly comprehensive set of tools, including customizable invoices, expense tracking, and real-time payment processing.

The platform automatically synchronizes data between desktop and mobile devices, ensuring users have full visibility of their financial operations anywhere. Its built-in dashboard provides an overview of income, overdue invoices, and upcoming payments—all displayed clearly for easy management.

Wave also integrates with payroll and receipt scanning, allowing users to manage all aspects of business finance under one roof. While its free version covers nearly everything most small teams need, Wave’s paid add-ons—such as professional bookkeeping support—make it even more powerful for those seeking extra reliability.

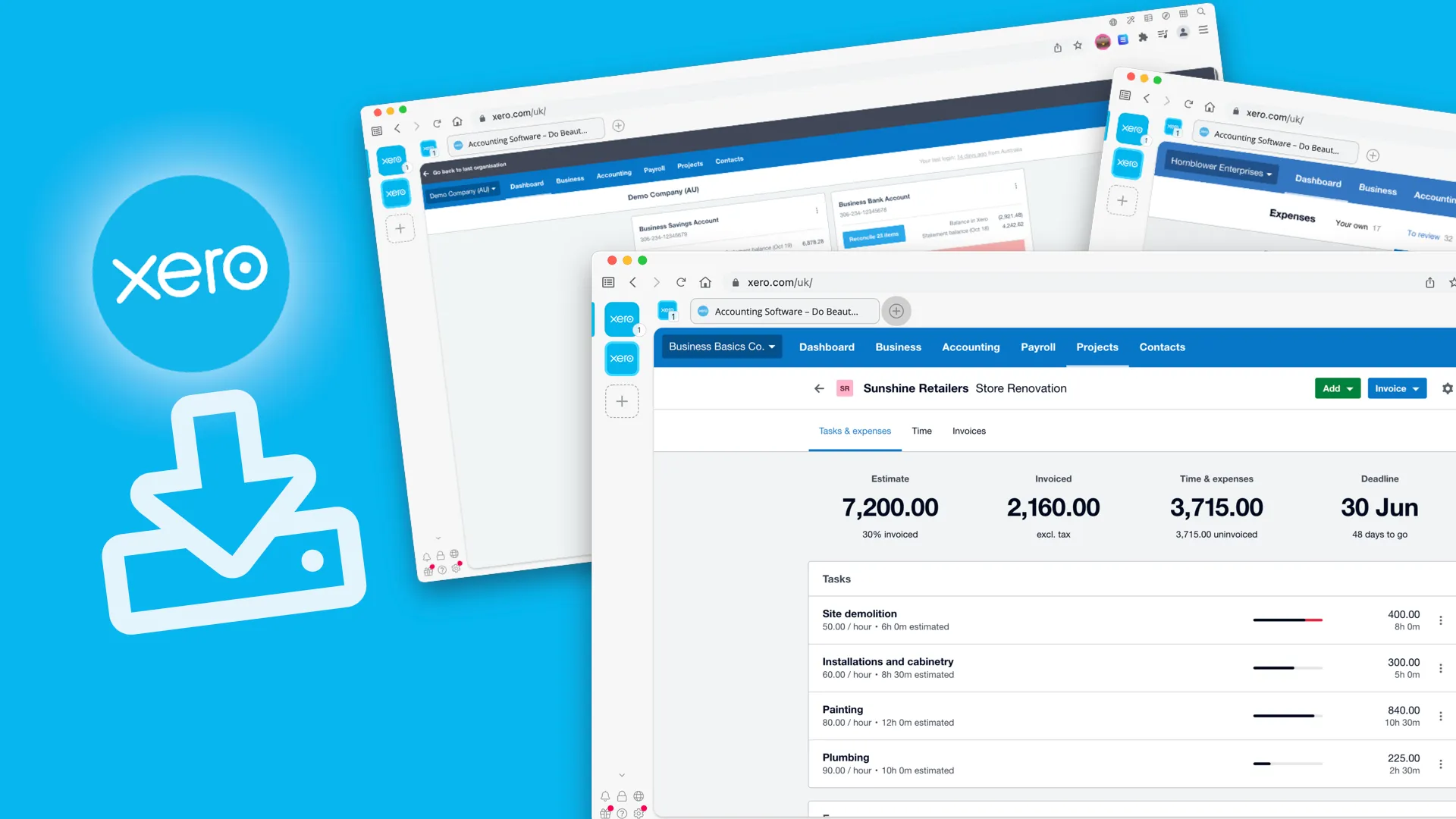

5. Xero – Cloud-Based Precision for Accounting Professionals

Xero is a cloud-based accounting app designed for accountants, bookkeepers, and small business owners who value precision and automation. It supports seamless collaboration by allowing multiple users to access financial data simultaneously. Its invoicing system integrates directly with bank feeds, automating payment tracking and reconciliation.

One of Xero’s key features is its ability to generate recurring invoices and apply real-time exchange rates for global clients. It also offers advanced reporting tools that analyze revenue trends, unpaid invoices, and tax obligations. These analytics help businesses identify areas for growth and optimize billing strategies.

Xero integrates with over 800 third-party apps, from CRM tools to e-commerce platforms, ensuring flexibility and scalability. The mobile app further empowers users to approve transactions, send invoices, and monitor payments on the move. In short, Xero turns traditional accounting into an efficient, data-driven experience.

6. Invoice Ninja – Open Source Flexibility for Freelancers

Invoice Ninja is an open-source invoicing platform that caters to freelancers, agencies, and small businesses seeking flexibility and control. The app allows users to create unlimited invoices and quotes for up to 20 clients in its free plan. For professionals managing multiple projects, Invoice Ninja’s task and time-tracking tools seamlessly connect with the billing system.

The platform supports more than 40 payment gateways, giving clients plenty of ways to pay invoices easily. Users can design branded templates, automate reminders, and track expenses with built-in analytics. Its self-hosted option offers businesses complete ownership of their financial data—an advantage for privacy-conscious users.

Beyond invoicing, Invoice Ninja includes client portals that let customers view their billing history and make payments directly. It’s a lightweight yet powerful option for those who want both transparency and autonomy in managing finances.

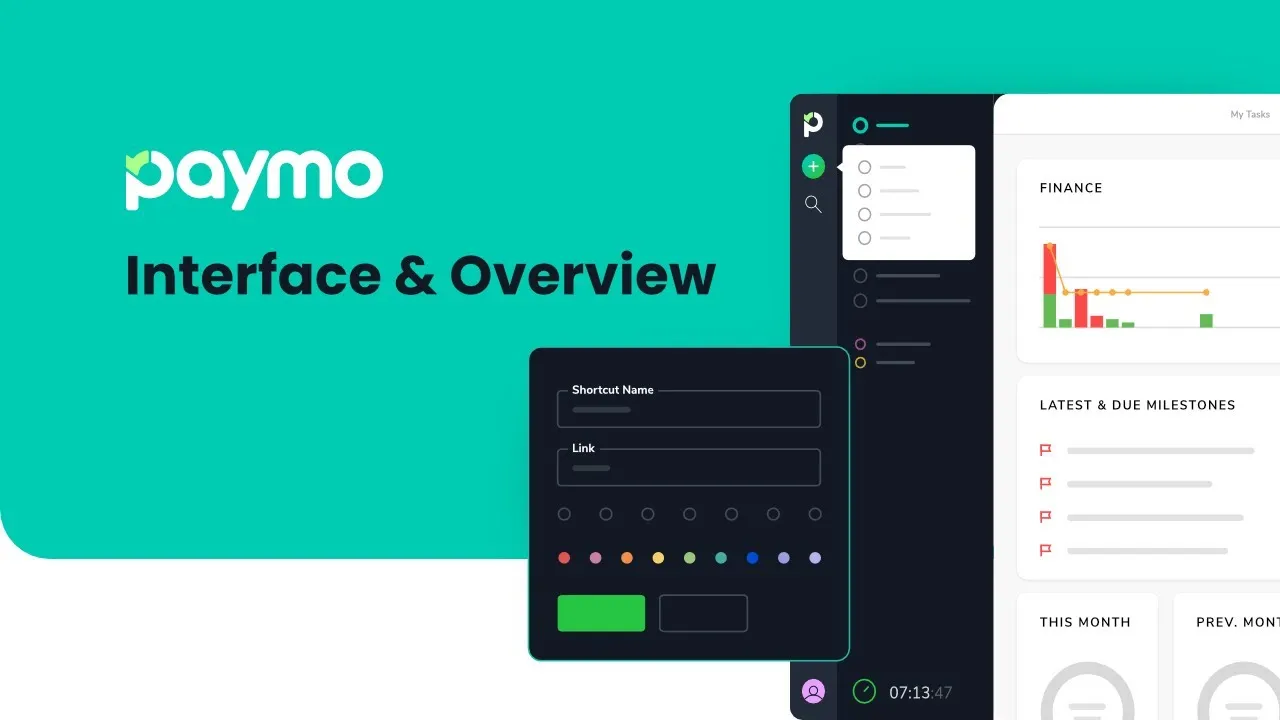

7. Paymo – All-in-One Project and Billing Management

Paymo stands out as an integrated project management and invoicing app tailored to teams that work on client-based projects. It combines time tracking, task organization, and billing into a single ecosystem. Users can generate invoices based on tracked work hours, ensuring accuracy and transparency with clients.

Paymo’s invoice creation process is smooth and fast. Users can convert completed project timesheets into branded invoices, apply taxes, and send them instantly via email. The app also tracks overdue payments and sends automated reminders, reducing the need for manual follow-ups.

Its powerful reporting dashboard visualizes project performance, financial summaries, and team productivity. For agencies juggling multiple clients, Paymo ensures no billable hour goes unrecorded. Integration with PayPal, Stripe, and Square simplifies payment collection, while cloud syncing ensures real-time access to billing data. It’s ideal for modern teams seeking complete workflow efficiency.

Why Invoice & Billing Apps Are Essential for Modern Professionals

In today’s fast-paced digital economy, relying on manual billing methods is not just inefficient—it’s risky. Automated invoicing apps eliminate human errors, provide accurate tracking, and save time through instant calculations and reminders. Professionals can monitor payments, send branded invoices, and receive instant notifications when transactions occur.

Furthermore, these apps improve client relationships by ensuring transparency. Clients receive timely invoices, reminders, and receipts, creating a smoother business experience for both sides. The analytics and financial reports offered by most apps also allow businesses to make informed decisions, predict revenue trends, and manage budgets effectively.

Choosing the Right App for Your Business Needs

Selecting the best invoicing app depends on your business type, client base, and financial goals. Freelancers may prefer lightweight, user-friendly platforms like FreshBooks or Invoice Ninja. In contrast, growing companies might benefit from scalable systems such as Zoho Invoice or QuickBooks.

Before committing, consider factors like integration with payment gateways, automation features, and cost-effectiveness. Most leading apps offer free trials, allowing users to test interfaces and ensure compatibility with their workflows. The right choice can reduce administrative stress and enhance financial accuracy for years to come.

Final Thoughts

Invoice and billing management apps have become indispensable tools for professionals across industries. Whether you’re an independent freelancer or a business managing hundreds of clients, these apps bring structure, automation, and professionalism to your financial processes.

The seven apps highlighted here—QuickBooks, FreshBooks, Zoho Invoice, Wave, Xero, Invoice Ninja, and Paymo—each offer a unique approach to billing, suited to different business needs. By embracing the right technology, you not only simplify invoicing but also strengthen your business’s financial foundation.